It needs to be more comprehensive AND more specific.

If not, you risk:

- Extended due diligence that already takes ~3 months

- Doubts about the viability and value of the deal

- Legal disputes and regulatory penalties

- Increased perceived risk for the buyer

- Post-acquisition financial difficulties

- Post-merger integration difficulties

- Millions or billions in losses

Daimler-Benz and Chrysler’s $36 billion merger failed because of poor integration planning which was not adequately addressed during the due diligence phase.

Google's acquisition of Motorola for $12.5 billion failed because it didn’t achieve the expected synergies and market benefits, largely due to insufficient due diligence and flawed strategic assumptions.

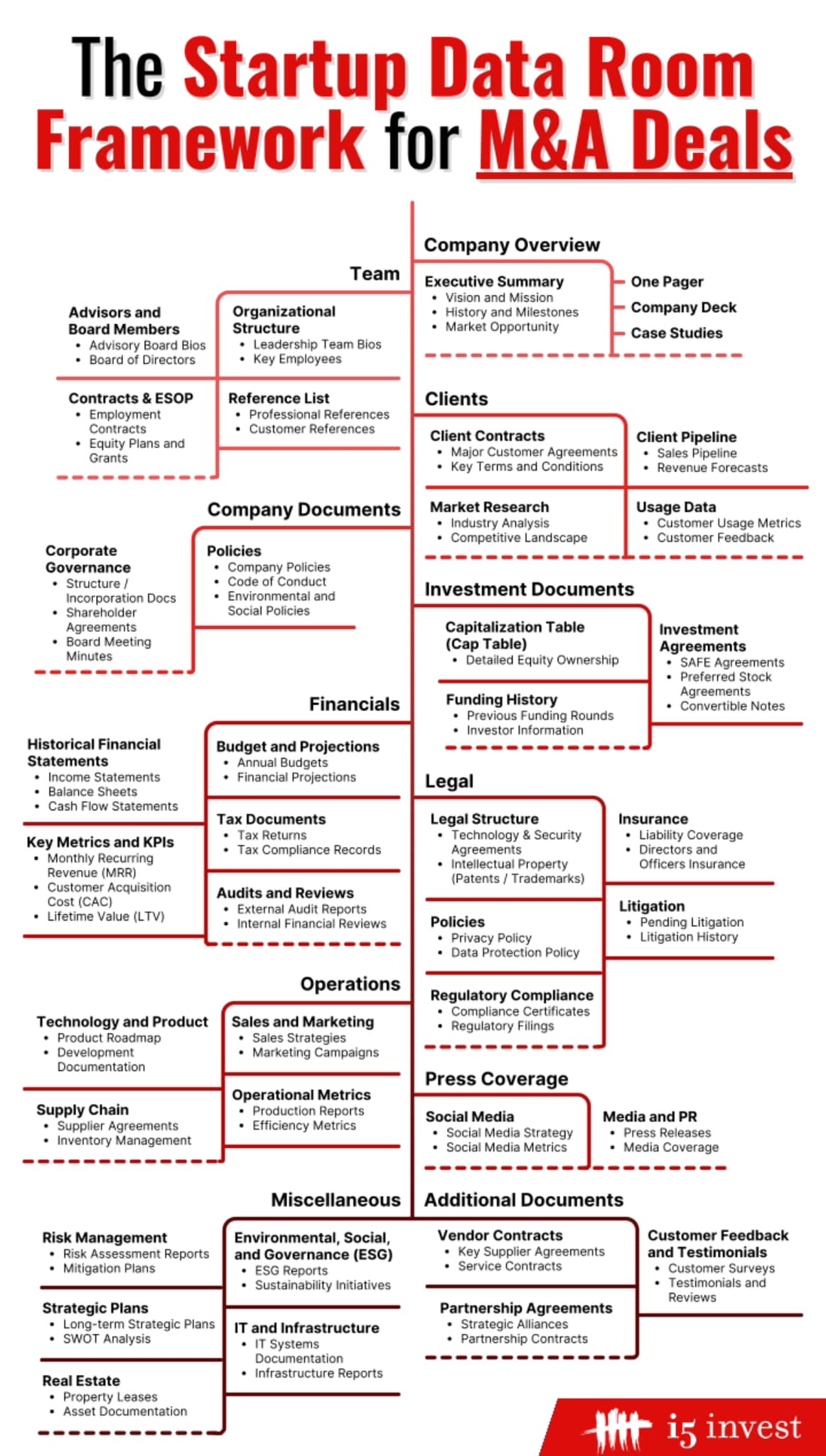

To identify synergies, potential challenges, and regulatory requirements…

You need a data room like the one below.

It can serve as a data room framework.

Cre: i5growth

🔎 Xem báo cáo chi tiết TẠI ĐÂY

This article was compiled by Admin CTO Vietnam Network.

#VMR

GET MORE INTERESTING INFORMATION, JOIN NOW:

VIETNAM Market Report: https://www.facebook.com/groups/vietnam.market.report

CTO Vietnam Network: https://www.facebook.com/groups/cto.platform/

Tech Preneur Community: https://www.facebook.com/groups/cto.startup

Tags

Xu hướng thị trường